Are You Looking For Guidance And Support

To Help You Reach Your Financial Goals?

MAKE YOUR LIVING A GOOD START WITH

Financial Planning For Wealth Creators

We specialize in Strategic Financial Planning that is geared to protect the best interest of families. Our Life Insurance options are tailored specifically to fit the vision of our client’s financial security goals.

"I am committed to help individuals and businesses achieve their financial goals and build a strong financial foundation for the future."

-Dominique Jani (Financial Advisor)

Myths and Facts About Life Insurance They Won't Tell You

Our Top 3 Misconceptions About Life Insurance Revealed

MYTH#1: Life Insurance Is Only Beneficial After My Death

FACT: Life insurance is a risk reduction strategy. Risk must be connected to both dying and living for too long. The average lifespan is increasing as a result of advances in science and medicine. How would you handle your bills if you were to stop working at 60 and live to be 90? Investments are also subject to risk, which can be affected by market turbulence, poor financial planning, or a lack of financial discipline.

You may protect your financial future by purchasing insurance. There are several ways you might establish a corpus to support yourself in retirement, pay for astronomical medical costs, or increase your wealth. A timely investment in the appropriate insurance will always pay off for you.

MYTH#2: I Don't Need a Second Policy Because My Company Covers Me

FACT: Your employer only provides insurance while you are working for them. Once you quit or retire, the insurance policy expires. If there are financial difficulties at the company, the policy or benefits can potentially be canceled. If that happens, you will be stranded just when you most need insurance coverage.

However, it won't be sufficient to meet the needs of your future family, such as those related to children's education, marriage, aged parents' medical problems, the rising cost of living, etc. Second, the insurance policy might only provide a death benefit. This means that if you do not have a financial plan in place to cover your needs after retirement, you will be on your own when you retire.

It is recommended to add another insurance policy that is tailored to your future needs to your employer's coverage. Choose a policy that will let you maintain your standard of living while also providing financial security for your family in the event of your passing.

MYTH#3: Life Insurance Is Expensive

FACT: The cost of life insurance is the most adaptable premium out there. It is based on a number of variables, and it can be gradually increased and changed to fit your ability to pay the premium. The premium rate for any insurance, whether it be a pure risk product or a risk cum savings plan, is cheaper the younger you are.

Term insurance frequently offers a significant amount assured for a very small payment. You can always start modestly and increase your coverage as your income and obligations increase over the course of your life.

"Create Wealth And Leave Something

For Your Loved Ones...''

Our priority is helping you take care of yourself and your family. We want to learn more about your situation, identify your dreams and goals, and understand your risk tolerance. Long-term relationships that encourage open and honest communication have been the cornerstone of our foundation of success.

What is Indexed Universal Life Insurance (IUL)?

Life insurance is a risk reduction strategy. Risk must be connected to both dying and living for too long. The average lifespan is increasing as a result of advances in science and medicine. How would you handle your bills if you were to stop working at 60 and live to be 90? Investments are also subject to risk, which can be affected by market turbulence, poor financial planning, or a lack of financial discipline.

You may protect your financial future by purchasing insurance. There are several ways you might establish a corpus to support yourself in retirement, pay for astronomical medical costs, or increase your wealth. A timely investment in the appropriate insurance will always pay off for you.

Benefits of Indexed Universal Insurance

Cash Value Growth

Multiple Uses

Tax Advantage

Flexibility

The cash value of an IUL policy can potentially grow at a higher rate than a traditional whole life insurance policy, due to the participation in the performance of a stock market index.

The cash value of an IUL policy can be used for a variety of purposes, including supplementing retirement income, paying for unexpected expenses, or providing funds for a child's education.

The cash value of an IUL policy grows on a tax-deferred basis, meaning that policyholders do not have to pay taxes on the growth until it is withdrawn. However, the accumulated cash value is never taxed when accessed.

IULs allow policyholders to choose how much coverage they want and how much they want to pay in premiums. They also allow policyholders to adjust their premiums and death benefit as their needs change over time.

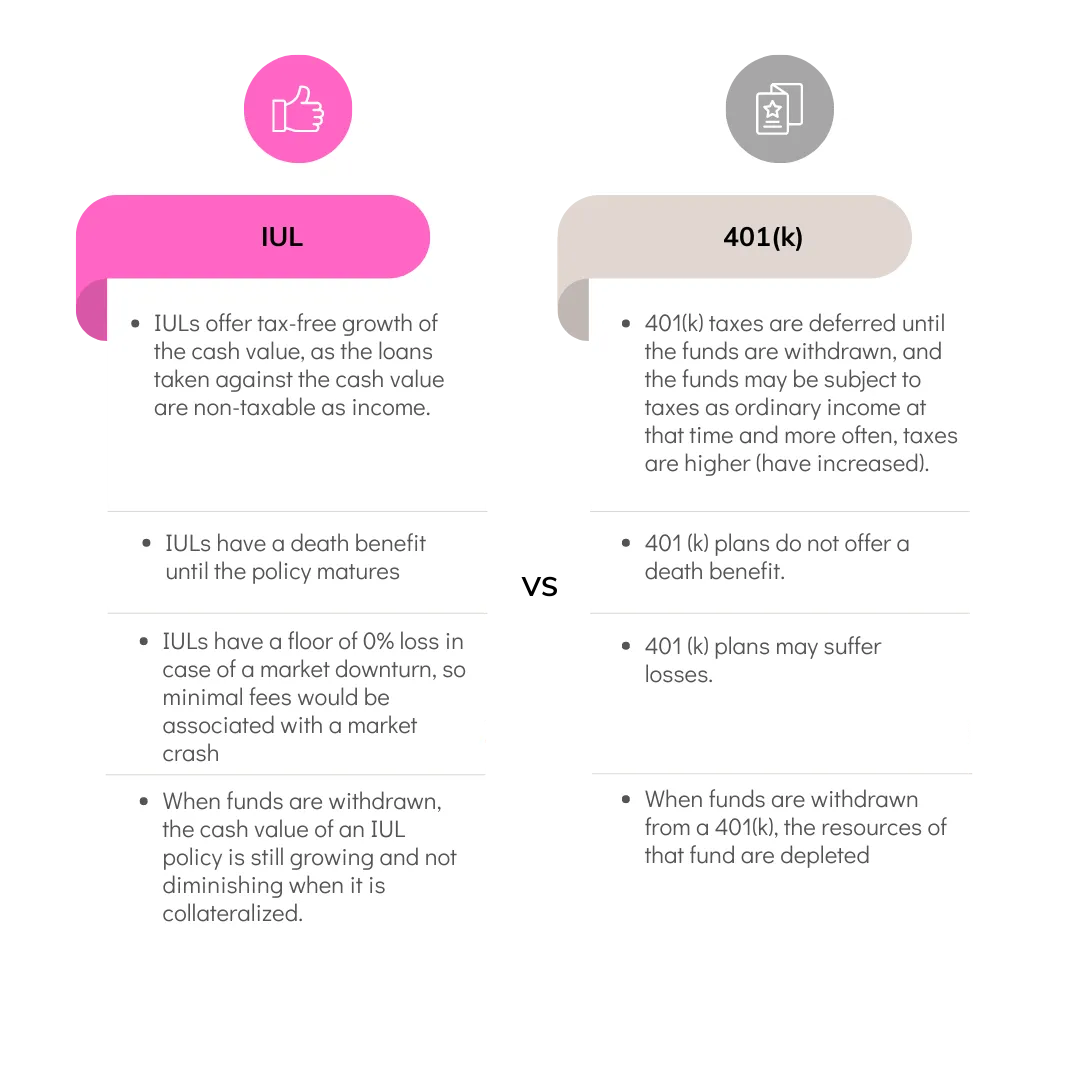

IUL and 401(k) Comparison

Other Financial Offers

TERM LIFE

INSURANCE

Term life insurance is a type of life insurance policy that has a specified end date (e.g., 10, 20, or 30 years) from the start date.

WHOLE LIFE

INSURANCE

Whole life insurance works as a permanent policy that builds cash value over time.

FLEXMETHOD LIFE INSURANCE

The flexmethod option is an asset-based lending strategy that seeks to generate cash flow by borrowing against the value of an eligible life insurance policy.

HOSPITAL INDEMNITY INSURANCE

Hospital indemnity insurance supplements your existing health insurance coverage by helping pay expenses for hospital stays.

BENEFITS OF UTILIZING A PERMANENT

LIFE INSURANCE POLICY

Protect your wealth from unstable and unpredictable markets.

Benefit from the potential tax free growth.

To make investments to expand your own sources of income.

Have the option to borrow against the policy with ease and less interest payments.

Those wanting to leave their heirs an inheritance can use permanent life insurance to pass down money to the next generation.

FAQ'S

How does the cash value of an IUL policy grow?

The cash value of an IUL policy grows based on the performance of a stock market index, with the insurance company offering a minimum guaranteed rate of return and potentially an upper limit or rate cap on returns. The cash value is credited with interest on a monthly or annual basis.

What can the cash value of an IUL policy be used for?

The cash value of an IUL policy can be used for various purposes, including supplementing retirement income, paying for unexpected expenses, providing funds for a child's education, and creating more wealth (acquiring additional wealth-creating assets).

How do IUL policies offer tax benefits?

The cash value of an IUL policy grows on a tax-deferred basis, meaning that policyholders do not have to pay taxes on the growth until it is withdrawn. However, the accumulated cash value is never taxed when accessed, as it is considered a loan.

Don't Let The Uncertainty Of The Future Hold You Back

From Achieving Your Financial Goals

Take Control Of Your Wealth Creation Journey With

Permanent Life Insurance Policy From Wealth Creators

Copyright 2025. All rights reserved